Are You a “BoomerPreneur”?

Attention, Boomers! You’ve built your business, watched it grow, and now you’re thinking about a transition—maybe even retirement. Is your future and place in history secured? Does the sale of your business factor into the quality of your retirement?

Baby Boomers are the most entrepreneurial generation in American history, with more than four million business owners employing nearly 50% of our country’s workers. And let’s face it, we Boomers have been through a lot: several recessions, a pandemic, and now a “growth recession.” Many Boomers are working longer than planned due to rapid technological change, black swan events, and market uncertainty. Boomers are fighters! Yet many are tired, and are looking to start their next chapter and diversify their wealth.

If you fit that description, this article is for you. And guess what? “BoomerPreneurs 2023” is the start of the next transfer cycle. It’s time to secure your legacy!

Why is that? By 2023, the youngest BoomerPreneurs will turn 58, and the rate of transition out of privately held business will likely increase. The critical question is: will they be able to find buyers among a younger generation who may or may not be interested in “standard” or “old-line” businesses run by Boomers?

This is the million-dollar question, literally. Statistical trends, unfortunately, point to the likelihood that only 20% of BoomPreneurs will be able to sell their companies to outside private parties or have a “true M&A event.”

There are many reasons for this dilemma. But two of the critical factors lie in fundamental economic principles we’ve known since Economics 101:

- The law of supply and demand (we all know this one)

- The axiom that “all costs drive toward zero” in a capitalistic society

Sure, these are simple principles, but they can have a profound impact on BoomerPreneurs as they look to exit, particularly for those who are counting on income from the sale of their company for retirement.

Many businesses are now worth less than they were at the previous economic peak pre-pandemic (2019) or are just catching up to that former value post-pandemic. As a result, owners have postponed the sale of their firms in hopes of recapturing that lost value. Meanwhile, BoomerPreneurs are now increasingly deciding—or recommitting—to selling or transitioning their businesses.

Here is where the supply and demand principle can hurt the Boomer, as you are not alone in this thought. With a glut of BoomerPreneurs retiring, pent-up demand to sell, and the law of supply and demand in action, getting the price you want for your company will be challenging unless you’re well-prepared and differentiated from your competitors.

As for the “all-costs-drive-toward-zero” principle, unless a business stands out, the fact that many businesses are coming onto the market at the same time means many will sell for lower multiples. In addition, competition from new or disruptive technologies may push your company’s value down even further unless you are actively reinvigorating your product and company lifecycle with new technologies.

So, this begs the question: when IS the right time for BoomerPreneurs to sell?

Seizing Your Window of Opportunity

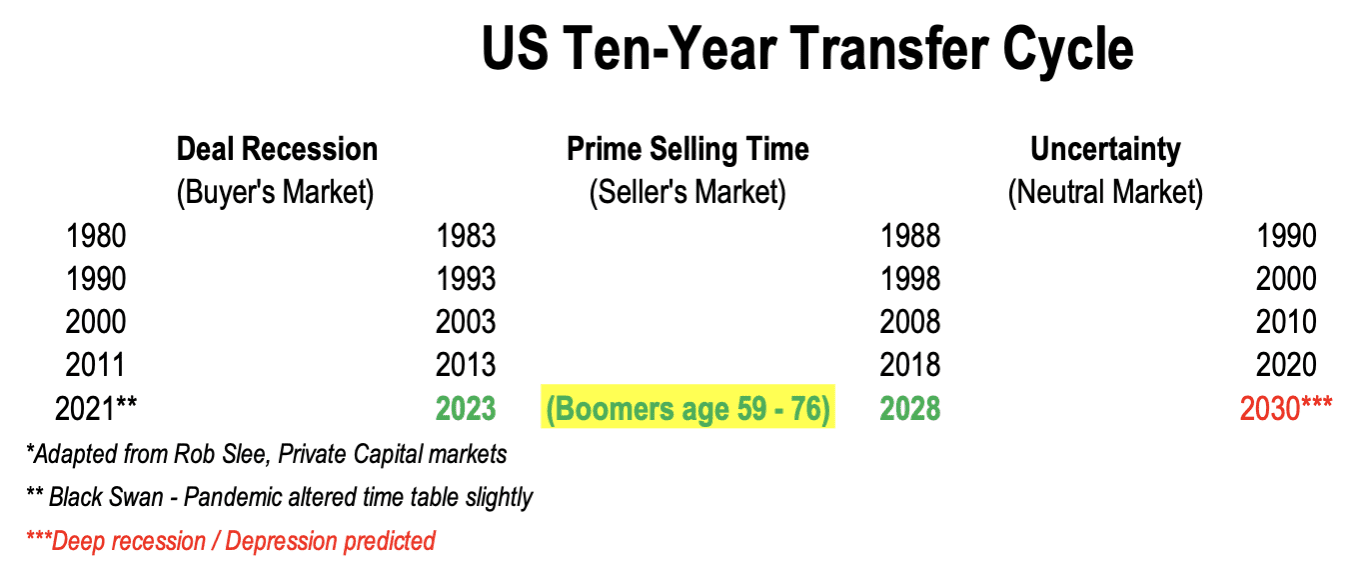

Borrowing and extending Rob Slee’s famous Transfer Cycle Analysis, the window of opportunity to sell based on previous investments and transfer cycles is open for a five-to-six-year window, depending on how post-pandemic markets fully and finally recover in each sector.

Furthermore, well-known economist Alan Beaulieu of IRT Economics, one of the nation’s oldest economics consultancies with a 94.7% prediction success rate, predicted the next recession would arrive in 2019 (the end of the last transfer cycle). He was right in an odd way, with the pandemic ending the highest economic prosperity window in recent history. And, as a notable nod to the next transfer cycle, Beaulieu and other economists predicted the next recession to be a depression around 2030 (due to several factors, most of which are not in BoomerPreneurs control: aging populations / demographics, debt loads, etc.).

If you have lost value in your company during the pandemic or have delayed the sale of your firm until the economy improved, you might be asking yourself if you want to wait through the next recession—or get prepared instead.

One must ask:

- When is it right for your personal and business timeline?

- Can you create enough profit to achieve the multiple you want or need? What is the cost of that time or capital during that time, and do you want the risk associated with growing the company further?

- How comfortable are you with market or transaction risk? Often we find those that wait too long (timing markets, overdue corporate lifecycle, debt payment issues, deferring maintenance, higher cap-ex costs, etc.) pay a disproportionate price compared to those who exit on their own time and terms, somewhat unrelated to current market conditions.

As middle market companies tend to trade for tight target ranges and are less susceptible to sizeable public market swings, rarely does a middle market seller sell too early in M&A.

The good news is that you are in control (of what you can control). Unlike the farmer whose evidence of the right time to harvest is fruit falling from the tree, I suggest buyers seriously consider the cycle we are currently in as a time to prepare, so you can be one of the first—not the last—to come to market in the upcoming 2023 transfer cycle.

We’d be happy to discuss your results with you. Reach out to discuss the best path for your company to grow and for you to build generational wealth through the recapitalization or sale of your private company. 253-370-8893 | Craig.Dickens@meritinvestmentbank.com | @MandAexit.

0 Comments